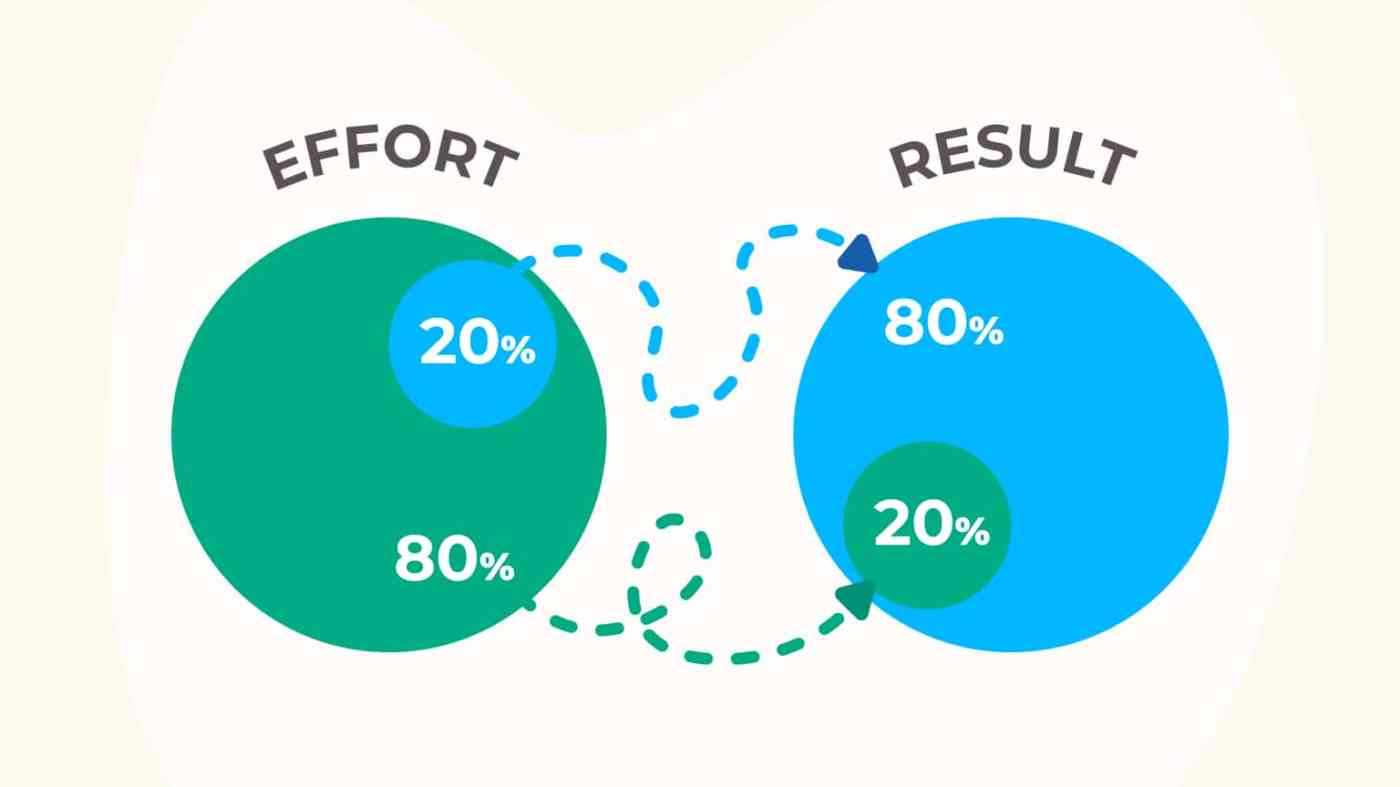

We would have all heard of it at some point or the other. So the 80-20 rule says that 20% of what you do results in 80% of your outcomes. Put another way, 80% of your outcomes result from just 20% of your inputs. Also known as the Pareto principle, the 80-20 rule is a timeless maxim that’s all about focus. We tend to focus on multiple things at the same time, that we don’t realise that it’s the small things that if done consistently fetches us the maximum results. They keyword here being ‘consistent’. So instead of getting pulled in hundred different directions, narrow down the small actions that you need to regularly in order to achieve your goals.

Now obviously I am going to apply this to investments and see what are those small action items that can be implemented

Let’s see how to apply the 80/20 principle in our lives.

- Salary – Let’s start with your salary, Save minimum 20% of your salary every month. Mind you, doing it once in six months or whenever is ineffective, it has to be done every month without fail, the best way to implement this is to automate it. So that you first save and spend what’s left.

- Investment – SIP is the most productive and effective way of building, let 80% of your investing be through SIP. It builds discipline and consistency. The two pillars of investing. The rest can be kept for doing lumpsum investment as and when you get opportunities.

- Goals – 80% of your wealth will be taken up by maximum 20-30% of your goals (house, education, retirement), so focus your investments on these goals. Ensure that you don’t miss out on investing for these goals right from day one.

- Risk Management – Getting good returns and managing risk are the two sides of the coin. This principle helps in your risk management as well. Stay safe with most of your investments. But at the same time, you should consider at least 20% of your portfolio in medium to high-risk investments or even high to very high-risk investments (based on your risk appetite), especially for the long-term goals.

- Portfolio Review – Not all investments will perform, so keep reviewing your portfolio regularly, in all probability 20% of your investments will do exceedingly well or could be the other way, 20% of your portfolio may not be performing well. So, either way it’s important to monitor and take appropriate action.

Very often we have seen investors having general inertia and discomfort where decisions about money and investments are to be taken. Over and above that we tend to overthink about investments, resulting in unnecessarily complex financial portfolio and products. Properly applied, the 80/20 rule can help minimize the time and energy you have to put into maximizing your financial well-being. The 80/20 rule will help in prioritising your goals, serving as a compass and investments can follow the direction set for these goals. That too, with minimal effort .

Leave a comment