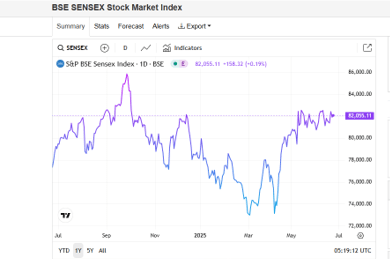

This is how the stock market behaved in the last one year. This behaviour of highs and lows is a reflection or reaction to the goings on of the world.

The world as we knew it last year no longer exists, the movement in stock market can tell you the entire story of the world.

- Right from the uncertainty of the General elections results in India in June 2024,

- US Fed rate hike speculation and global economic slowdown fears impacting FIIs’ behaviour, triggering outflows.

- US Presidential elections uncertainty

- Low earnings by Indian firms in the first quarter of the year (Jan – March 2025)

- US Tariffs and the Geopolitics of it all with India and other countries.

- Crude oil prices possibly spiked due to geopolitical tensions (e.g., Middle East unrest).

- April – May 2025 saw some settlements or let’s just say clarity on direction, so investor confidence was back and FIIs back too.

- India saw Good GDP and GST numbers; Banks acted promptly with rate cut and CRR cut in a phased manner

- Ind PAK ceasefire

Through it all, Gold has been the saving grace for the investors who invested in it, thereby bringing back focus on asset allocation.

If you have not been tracking it, then you are in a zen mode as you should be.

With all this action around what did you do.

For you as an investor it should have been a long, boring yet fruitful journey, you just had to continue doing what you were doing earlier, i.e. Invest, and invest more. Of course, provided your circumstances were not compromised. Every fall gives us an opportunity to invest for long term. However, the point is even if you didn’t do anything and just sat tight on your portfolio thru this entire volatility you would still stand to gain.

Now here’s the issue, some investors feel that when there’s so much action in the market, the advisors also should be equally busy with the portfolios. They believe that advisors should make changes, or do something, to either protect or make more gains. So I want to clarify at this point that, if you have your asset allocation and investment strategy right in the first place, we don’t need to do anything but sit quietly and let the portfolio do the work for you. Any action taken during such a volatile situation could be detrimental to the portfolio. After every major event or episode, be it domestic or international, there are people giving opinions, ideas and tips about companies, industries, sectors, funds etc., whilst it’s good to be updated about it, it does not mean that it will be necessarily suitable for you.

Now could be the time to breathe a sigh of relief, peek at your portfolio and see where you stand versus your goals and tweak if required. Your aim should be to chase goals and not trends. Mind you, this phase may not have ended and could turnaround once again since the geopolitics situation is fragile. That said, Market cycles will come again and again, reasons could be different for each cycle.

So as an investor wanting to build wealth, chase your goals and not trends, continue investing (and investing more if possible, whenever market gives opportunities) and stay bored with your portfolio and investment journey. As George Soros said – If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.

Leave a comment