Dussehra , Vijaydashmi, Durgotsav, Navratri , is celebrated tomorrow in a variety of ways in India. All the legends about Dussehra portray fascinating narrations and stories that inspire us to side with the good and destroy the evil.

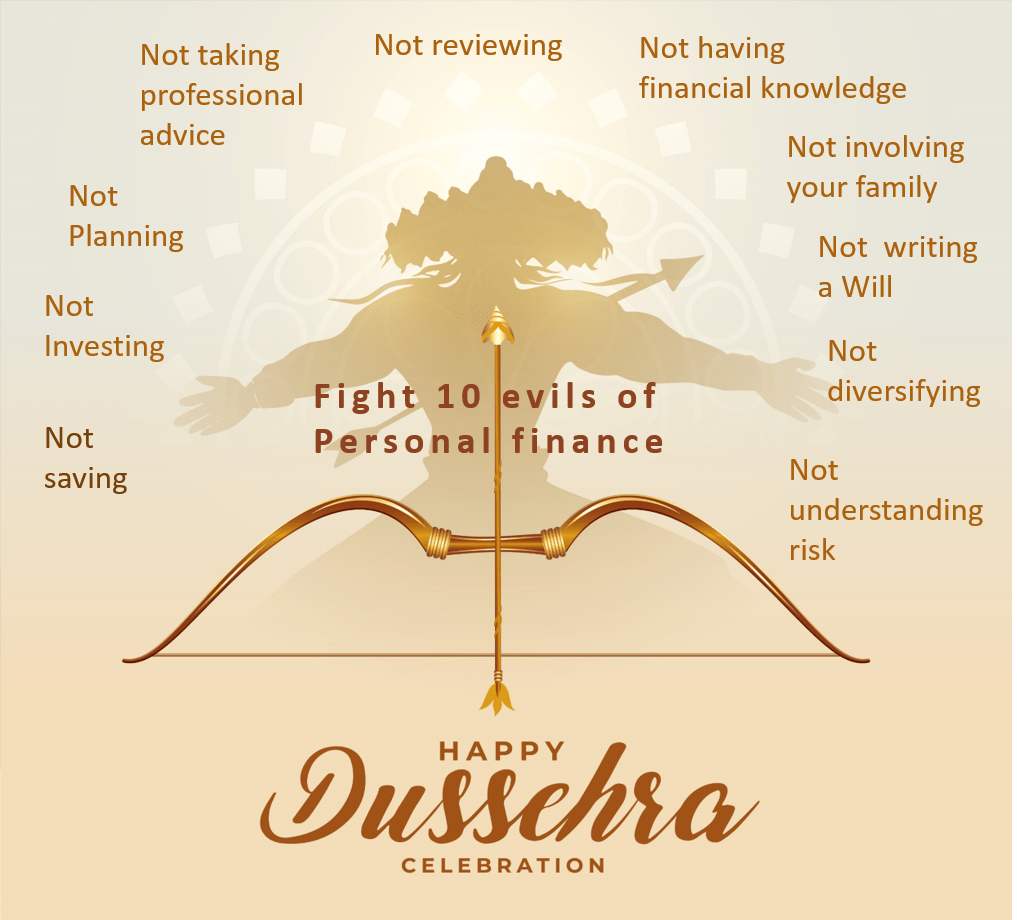

Personal finance impacts every aspect of our life, we need to be engaged in it actively. Let’s look at the 10 evils of personal finance and how to fight it.

- Not saving. One of the biggest evils, it’s the starting point of your financial journey. You should follow the 50-30-20 formula. 50% of your income for needs, 30% for your wants and 20% of your income to be saved.

- Not investing. Saving is not investing. You have to invest the money saved, in different financial products, that will help grow it further. Investing in the right financial products make the money saved, work for you.

- Not planning. Your life has many milestones and goals that require money, investing cannot be done randomly. You have to give your money direction. You need to have a financial plan that helps you achieve all the goals.

- Not taking professional advice. It’s critical to invest in the right financial products. This requires understanding the different financial products and mapping each one to your goals. Financial Advisors are qualified, they study the products, do an in-depth research and review of the different financial products and only then suggest it. So, leave it to Financial Advisors to manage your investments, it’s their core competency.

- Not reviewing. Just like your life that is constantly evolving, your financial plan also needs to evolve. The objective of a periodic review is to re-calibrate, add new goals, delete achieved goals, edit existing goals, along with monitoring the product performances.

- Not learning about the financial products. A basic financial knowledge is required so that you understand what your financial advisor tells you. The knowledge will make you ask the right questions to your advisor.

- Not involving family. Financial decisions impact the entire family so its important they are part of the discussion. The more you’ll discuss about it, the healthier the relationship with money will be.

- Not making a will. Save your family from legal disputes and financial distress by writing a will. It’s the most practical thing to do. A will eases the process of distribution of assets without the need to go through a court process, which can take months.

- Not diversifying investments. Having all investments in a particular sector/product can be highly risky and counterproductive. Instead understand the different financial products and map them according to your goals, timelines and risk-taking ability

- Falling to temptation for high returns and investing in unregulated products. Its important to understand there is always a Risk Return trade off. High returns don’t come without high risk and low risk always means low returns. Equally important is to invest in a product which is monitored and guided by a regulator. The regulator ensures that the investor’s interest is always protected.

On this auspicious occasion of Vijaydashmi, lets take a vow to kill all the evils of personal finance. Your financial journey is a life long journey, make it a pleasant one.

Leave a comment